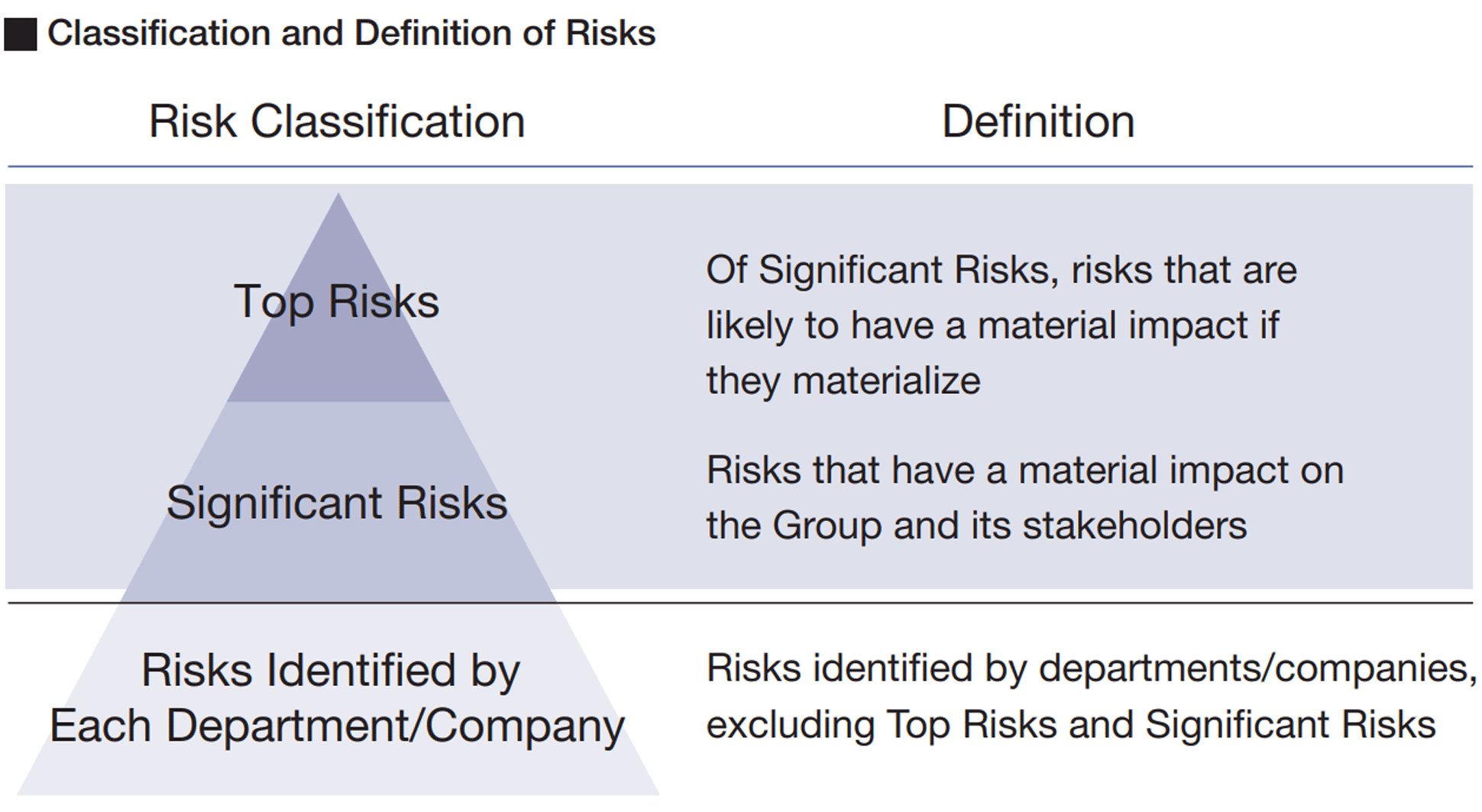

In accordance with the Companywide Risk Management Regulations and referring to the guidance issued by Committee of Sponsoring Organizations of the Treadway Commission (COSO) as an international standard, we identify factors that hinder the KOBELCO Group’s sustainable development and enhancement of corporate value and take measures to address them. As targets for Compaywide risk management, we designate risks that have a material impact on the Group and stakeholders and require a Groupwide response as Top Risks and Significant Risks. These Top Risks and Significant Risks include ESG risks such as human rights, safety management, climate change, and natural disasters.

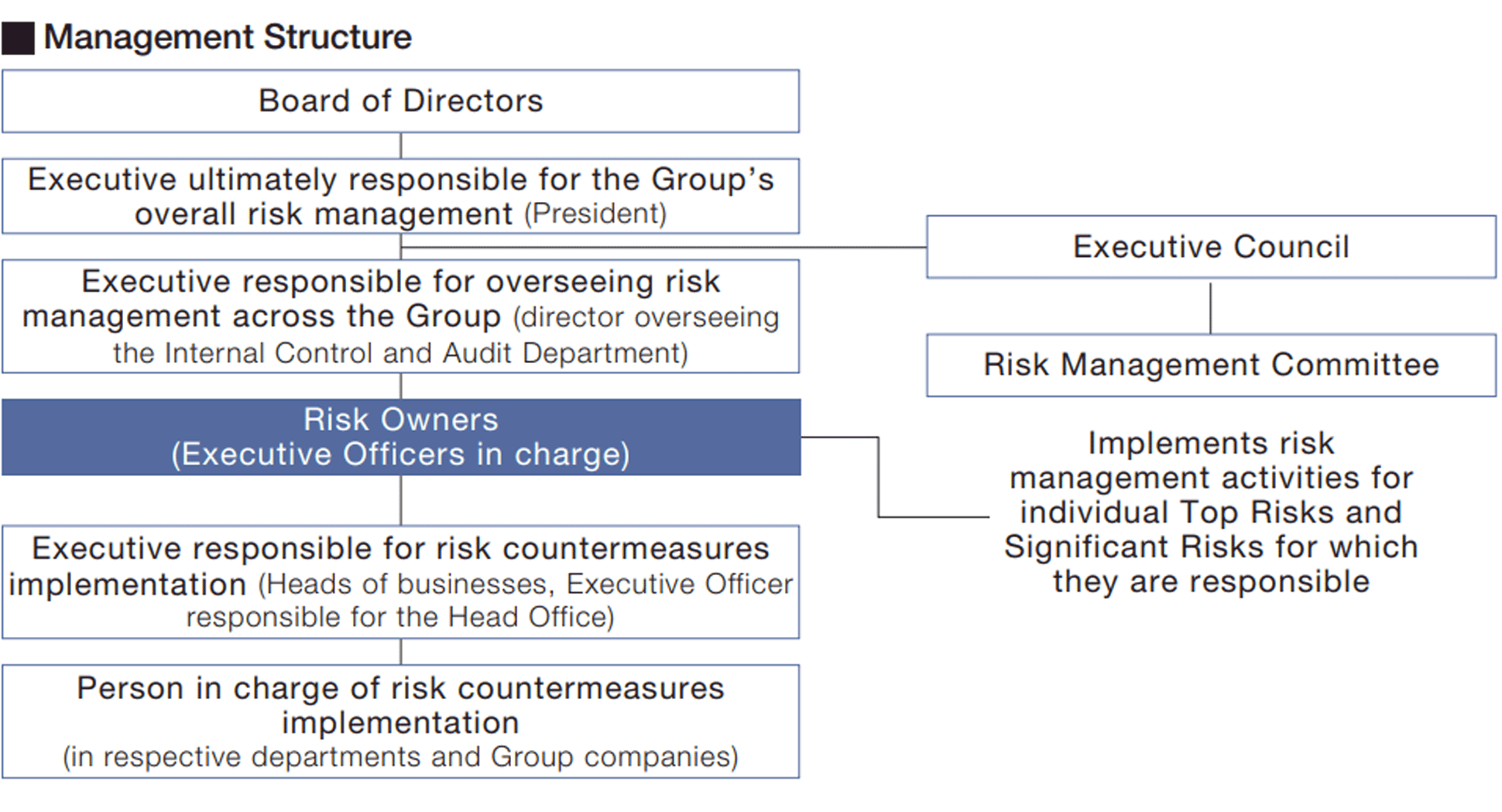

The president is the person ultimately responsible for the Group’s overall risk management, and the director who oversees the Internal Control and Audit Department is the person responsible for overseeing risk management across the Group. Meanwhile, individual risks are managed by the risk owners as the persons responsible for Groupwide management activities of each risk, and the countermeasures to these risks are implemented by the heads of businesses and the executive officer responsible for the Head Office under a risk management system that encompasses the entire organization. The Risk Management Committee has been established as an auxiliary body to the Executive Council. The committee undertakes tasks such as formulating and evaluating basic policies concerning risk management in general, planning specific policies concerning important issues in risk management, and approving and evaluating action plans for measures to reduce Top Risks and Significant Risks. The person responsible for overseeing risk management across the Group is appointed as the committee chair and all of the risk owners are appointed as the committee members. The status of the activities of the Risk Management Committee are periodically reported to the Executive Council, and instructions are given to the risk owners based on the results of discussions at the Executive Council. The risk management system, headed up by the president, is operated independently from the Audit & Supervisory Committee.

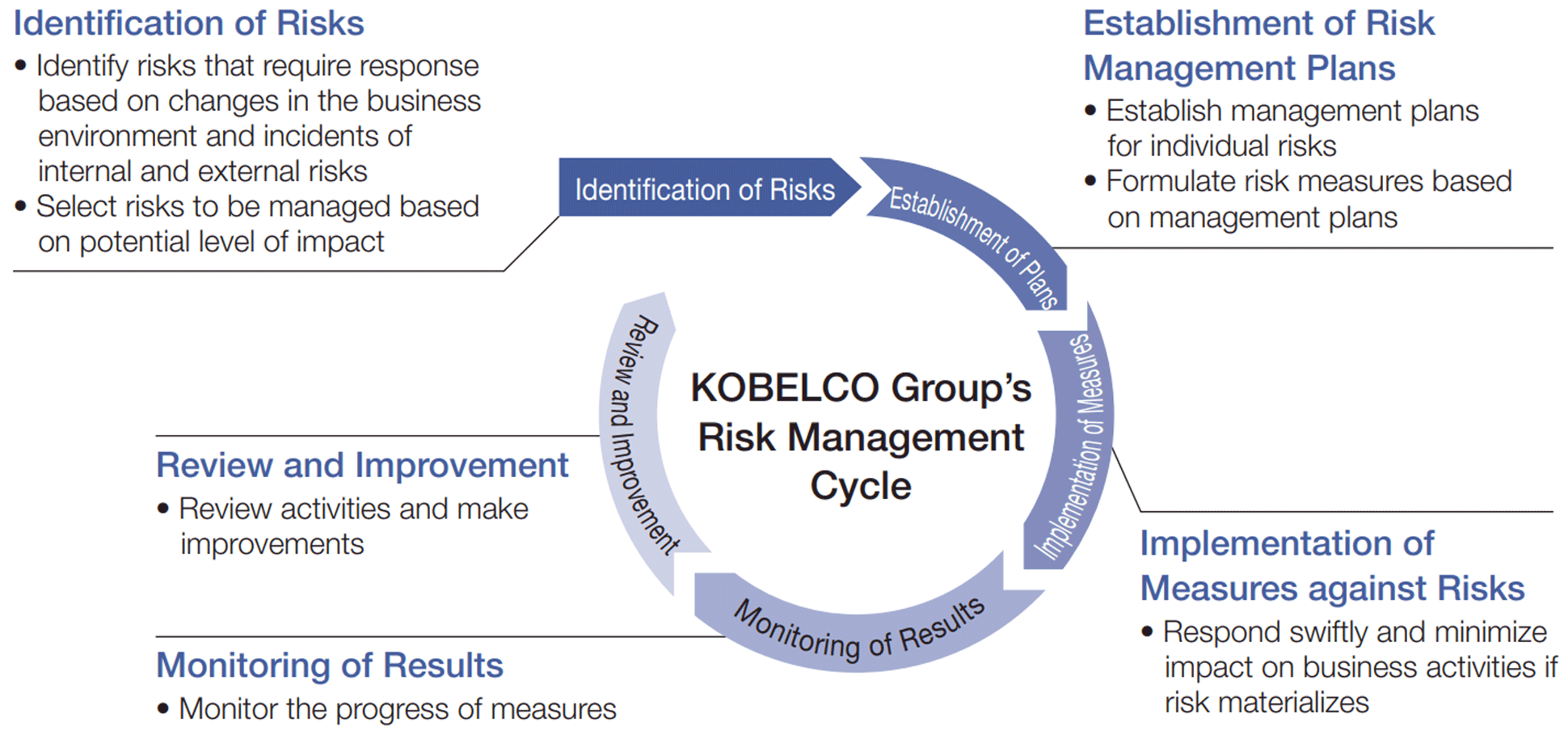

Under the direction of the risk owners, the management of individual risks is carried out by the person in charge of risk countermeasures implementation in each division in the following cycle: identifying risks, formulating risk management plans, implementing the plans, assessing results, and identifying required improvement for the following fiscal years. To ensure the effectiveness of our activities, the Board of Directors manages and supervises activities to address Top Risks and Significant Risks, including ESG risks. They review the annual results of activities in respective business divisions for the improvement of the plans for subsequent fiscal years. This approach to risk management is also actively employed at Group companies. In the event of an urgent and serious risk of loss with respect to risks including Top Risks and Significant Risks, we will appropriately communicate information and make decisions according to internal rules based on the Contact System in Case of Risk Occurrence and take appropriate measures to minimize damage.

| Risks | Actions (Examples) | Results |

|---|---|---|

| Natural disasters, pandemics |

|

【Actions for BCP】 |

| Quality |

|

【Actions for Quality】 |

| Safety management |

|

【Actions for Safety and Health and Lost Time Injury Frequency Rate, etc.】 |

| Environmental regulations |

|

【Actions for Environmental Management】 |

| Supply chain |

|

【Actions for Building Responsible Supply Chains】 |

With regard to KOBELCO Group business risks, matters that could have a material impact on the decisions of investors are described in the Annual Securities Report.