April 5, 2024

Kobe Steel, Ltd.

Kobe Steel, Ltd. announces that it has revised its remuneration system for directors, excluding independent directors and directors who are Audit & Supervisory Committee members, and executive officers (hereinafter collectively referred to as “executives”), effective April 1, as follows.

According to this revision, proposals to revise the payment limit equivalent to the maximum amount of performance-based compensation, as well as the maximum amount to be contributed as funds for acquiring the Company’s shares to the Board Benefit Trust (BBT) will be submitted to the General Meeting of Shareholders scheduled for June.

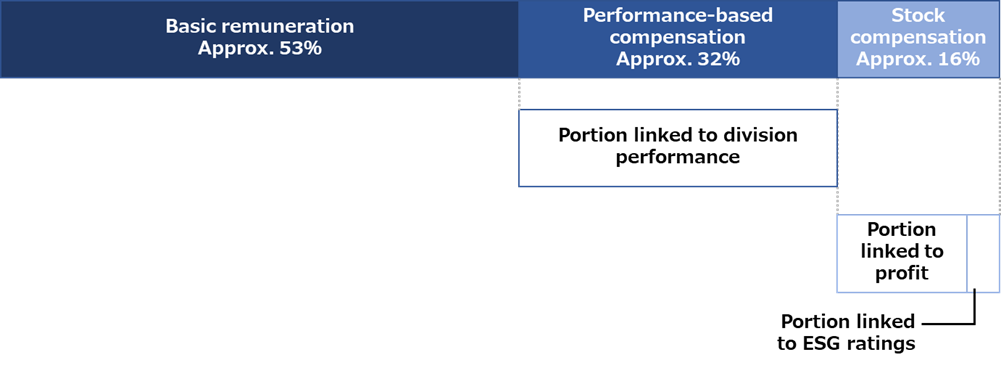

The Company's executive remuneration consists of basic remuneration, performance-based compensation, and medium- to long-term incentive compensation (hereinafter referred to as “stock compensation”). Among them, performance-based compensation and stock compensation will be revised as follows.

The ratio of performance-based compensation to basic compensation will be increased as follows in order to increase incentives for executives to improve business performance.

| Position | Ratio of each compensation category (Basic : Performance-based : Medium- to long-term incentive) |

|

|---|---|---|

| Current | After revision | |

| President, CEO and representative director | 100:30:30 | 100:60:30 |

| Executive vice president and representative director | 100:30:30 | 100:50:30 |

| Director and executive officer | 100:25:25 | 100:40:25 |

In addition, we will reduce the amount of basic remuneration for specific positions, taking into account the balance with similar-sized companies based on survey data on executive remuneration levels from external specialized organizations.

We will use ESG indices as a non-financial metric for executive remuneration. This will allow executives to actively pursue solutions to various ESG issues, including taking on the challenge of realizing carbon neutrality, in an effort to enhance our Group's corporate value over the medium to long term.

ESG indices will be used to determine payment coefficients for stock compensation, with the aim of sharing the interest in corporate value improvement with shareholders.

Specifically, we will use major global ESG rating agencies’ indices as a metric to evaluate all aspects of E (environmental), S (social), and G (governance) in a comprehensive and objective manner.

| ESG rating agencies |

Indices | Base value* | Reference: Our company’s latest scores |

|---|---|---|---|

| CDP | Climate change scores |

A | A- |

| FTSE | ESG scores | 3.9 or higher | 4.2 |

| MSCI | ESG ratings | AAA | AA |

* When the base values are met, the payment coefficients reach their maximum.

| Category | Description | ||

|---|---|---|---|

| Basic remuneration | Fixed amount will be paid in cash according to position and compensation rank. | ||

| Performance-based compensation | Portion linked to division performance | The payment amount will be determined by multiplying the standard pay amount for each position and remuneration rank by a coefficient ranging from 0 to 200% based on the performance management indicators* for the company and each business division. Payment will be made in one lump sum after the fiscal year has ended. *The base value of the performance management indicator for fiscal 2021–2023 is an ROIC of 5%, which is defined as a business management indicator under the medium-term management plan. |

|

| Portion linked to individual evaluation | The payment amount will be determined by multiplying the basic remuneration for each position and remuneration rank by a coefficient ranging from -5 to 5%, which is determined by comprehensively taking into account individual performance and the status of ESG-related initiatives. Payment will be made in one lump sum after the fiscal year has ended. | ||

| Stock compensation | The total of following points will be granted each year. The Company’s shares will be provided on a fixed date every three years according to the cumulative number of points granted.

|

||

(Note) The information on this web site is presented "as is." Product availability, organization, and other content may differ from the time the information was originally posted. Changes may take place without notice.